What is light vehicle tax?

First, there is the light vehicle tax, for which a tax notice is sent every year after Golden Week. This is a local tax paid to the city or town where the license plate is registered, and is levied on motorcycles of all engine displacements, from mopeds to large vehicles.

Light vehicle tax payment notices are sent every year after Golden Week.

The tax amount is determined according to engine displacement as follows:

[Light vehicle tax for motorcycles]

・Motorcycle Class 1 & New Standard Moped (50cc or less + 125cc or less with maximum output of 4.0kW or less): 2,000 yen

・Motorcycle Class 2 (over 50cc to 90cc): 2,000 yen

・Motorcycle Class 2 (over 90cc to 125cc): 2,400 yen

・Light two-wheeled vehicle (126cc to 250cc): 3,600 yen

・Small two-wheeled vehicle (over 250cc): 6,000 yen

The amount of light vehicle tax varies depending on engine displacement.

Incidentally, starting April 1, 2025, a new classification standard, “New Standard Moped,” will be added to the Class 1 Moped (Class 1 Motorized Bicycle). Motorcycles of 125cc or less that meet certain standards, such as a maximum output of 4kW (5.4PS) or less, will be treated the same as the previous Class 1 Mopeds of 50cc or less, and will be subject to the same light vehicle tax.

Who is liable to pay the light vehicle tax and how to pay it?

In the case of light motor vehicles, the person who owns the motorcycle as of April 1st is responsible for paying the tax. Therefore, if you acquire a motorcycle in the middle of the fiscal year, after April 2nd, you will not be taxed in that fiscal year, but will be taxed from the following fiscal year.

The payment deadline is generally the last day of May. However, if May 31st falls on a Saturday, Sunday, or holiday, the deadline may be the first weekday after that, such as June 1st or June 2nd. Also, some municipalities may send out tax notices in early June, in which case the due date may be June 30th, and deadlines often vary by municipality. For more information, please carefully check the tax notice you received or check with your local municipality.

The main ways to pay are as follows:

[Major payment methods for light vehicle tax]

・Financial institutions

・Post office counters

・Convenience stores

・Direct debit

・Pay-easy

・Smartphone payments (PayPay, Rakuten Pay, etc.)

・Credit cards, etc.

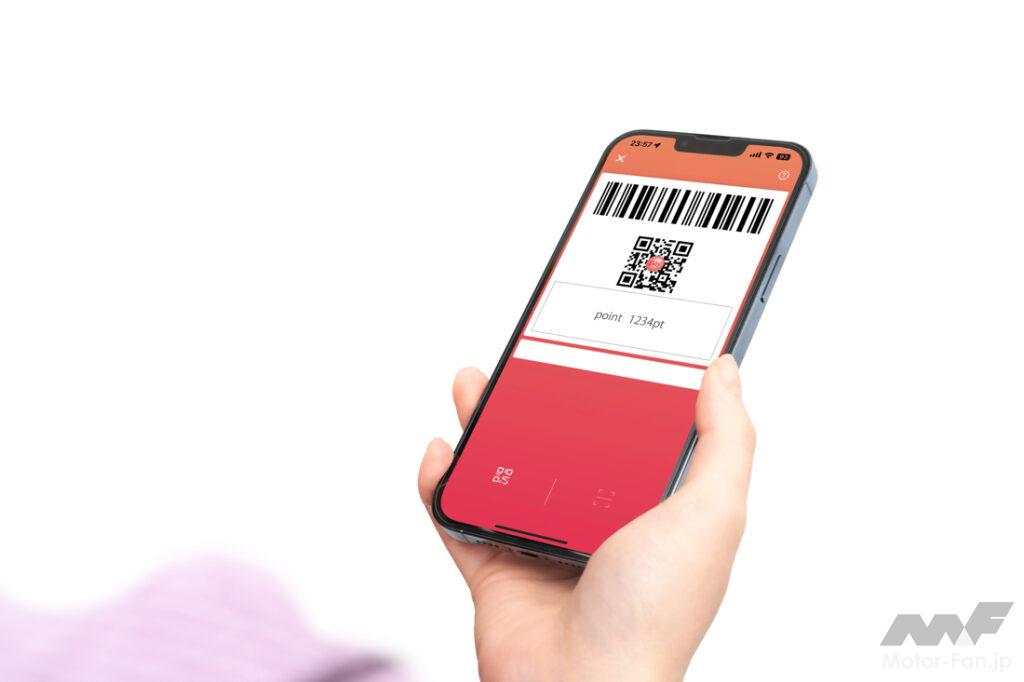

Recently, it has become very convenient to pay taxes from home using credit cards and smartphone payments. However, the specific payment methods vary depending on the city, town, or village, so please check with your local government for details.

Recently, cashless payments using smartphones and other devices have become possible (depending on the local government).

ADVERTISEMENT

Payment by credit card is also possible, but in some cases a fee may be charged (please check with your local government for details).

Weight tax is levied when inspecting a vehicle or purchasing a new car.

On the other hand, weight tax is a national tax paid to the government. Class 1 and Class 2 mopeds under 125cc are exempt from tax, but for motorcycles over 125cc, it must be paid when purchasing a new vehicle or when undergoing vehicle inspection.

Class 1 and Class 2 mopeds are not subject to weight tax (photo shows Yamaha XSR125)

The amount of tax and the payment method vary depending on the engine displacement, and for light motorcycles (over 125cc to 250cc) that do not require vehicle inspection, the tax is only levied on the owner when registering a new vehicle. Therefore, there is no tax when purchasing a used vehicle.

Weight tax is paid when purchasing a new car or when undergoing vehicle inspection.

On the other hand, for small motorcycles (over 250cc) that are subject to vehicle inspection, a three-year tax is paid at the time of new vehicle registration, and two years’ worth is paid for each subsequent vehicle inspection (both for private use). The tax amount also varies depending on the number of years that have passed since the first registration. The weight tax amount for each engine displacement is as follows:

[Weight tax amount when registering a new vehicle

] Light motorcycles (over 125cc to 250cc): 4,900 yen (first time only)

Small motorcycles (over 250cc): 5,700 yen (for 3 years)

*For private use

[Weight tax amount (for 2 years) at the time of renewal vehicle inspection]

・From the first year of registration until 2012: 3,800 yen

・From the first year of registration from 2013 to 2017: 4,600 yen

・From the first year of registration after 2018: 5,000 yen

*For small private motorcycles (over 250cc)

For motorcycles over 250cc that are subject to vehicle inspection, the weight tax increases when the vehicle has been owned for 13 years and when it has been owned for 18 years. This is called heavy taxation, and is based on the interpretation that vehicles that have been in ownership for a certain number of years have a greater environmental impact. For example, there will be a difference in the weight tax levied at the time of vehicle inspection between a new model that meets the latest 2020 (Reiwa 2) exhaust gas regulations and a motorcycle that has been registered for more than 13 years.

Motorcycles that have been registered for more than 13 years will be subject to higher weight tax at the time of vehicle inspection.

Be careful not to forget to pay light vehicle tax

For taxable motorcycles, weight tax is paid when the new vehicle is registered, and for motorcycles over 250cc, it is levied at the time of subsequent vehicle inspection, so there are few cases where problems such as forgetting to pay occur.

However, when it comes to light vehicle tax, which is paid every year, there are quite a few things to be careful about that could lead to you accidentally forgetting to pay it.

[Cases where you may not receive a tax notice]

For example, if you move, you may not receive a tax notice if you have not completed the procedure to change your motorcycle’s address, and you may unknowingly fall behind on your light vehicle tax. If you change your address, we recommend completing the procedure as soon as possible.

To change your address, you should go to the city, ward, town or village office that has jurisdiction over your new address for Class 1 and Class 2 mopeds, and to the land transport bureau that has jurisdiction over your new address for light motorcycles (over 125cc to 250cc) and small motorcycles (over 250cc).The procedures and required documents will vary depending on whether your prefecture or city, ward, town or village changes between your new and old address, so please check with your city, ward, town or village office for details.

For motorcycles over 250cc, you will need to change your address at the Land Transport Bureau.

[Cases where tax is levied even if a motorcycle has been sold]

In some cases, a light vehicle tax payment notice may be sent for a motorcycle that is no longer owned due to sale, scrapping, etc. As mentioned above, light vehicle tax is levied on anyone who owns a motorcycle as of April 1st of each year. Therefore, if the vehicle is deregistered or the ownership is changed by sale or other means by March 31st, no tax will be levied for the following year.

However, even if the sale is made before March 31, if the title transfer is delayed until after April 1, the previous owner will be obligated to pay and will receive a tax notice. This is a common problem in private sales, so be careful.

Even if the motorcycle is sold or scrapped before March 31st, if the ownership change occurs after April 1st, the previous owner may receive a tax notice.

If you don’t pay, your vehicle won’t be inspected!

If the light vehicle tax is not paid by the due date, small motorcycles (motorcycles over 250cc) that are subject to vehicle inspection will not be able to undergo vehicle inspection. This is because there is a rule that vehicles that cannot be confirmed as having paid the light vehicle tax will not be able to undergo a renewal inspection at the time of vehicle inspection.

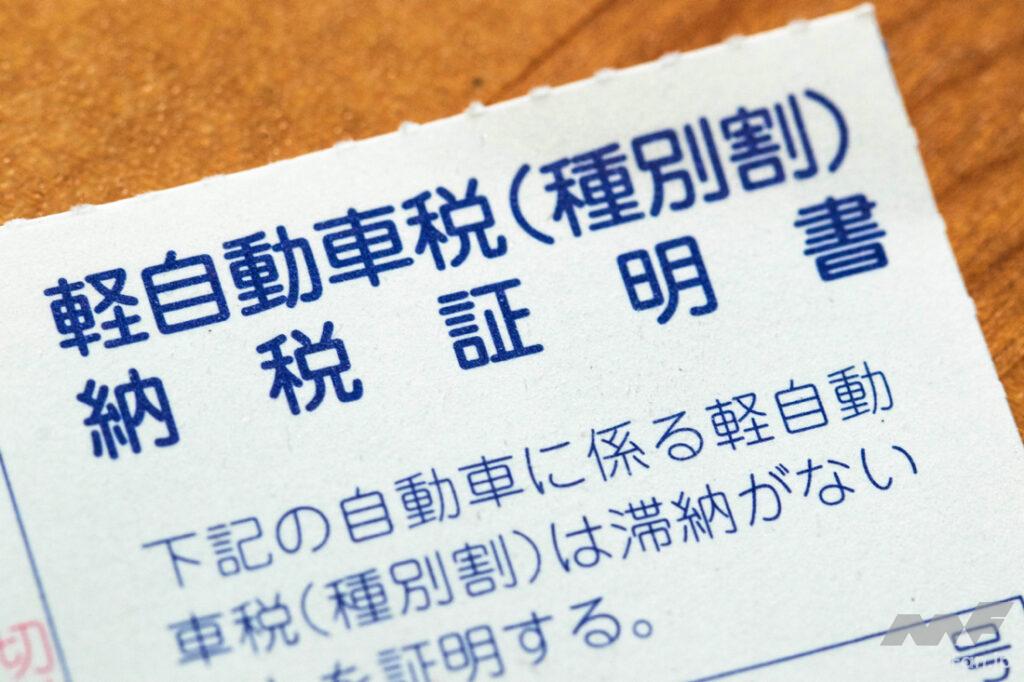

Incidentally, previously, it was necessary to present a “tax payment certificate” issued after paying the light vehicle tax during vehicle inspection. However, from April 1, 2025, it will no longer be necessary to present a paper (light vehicle tax) tax payment certificate.

This is because the One-Stop Service (OSS), which was already in place for cars and other vehicles, has been expanded to include small motorcycles, allowing people to check their tax payment status online. As a result, like cars and other vehicles, it is no longer necessary to present a tax payment certificate when undergoing vehicle inspection.

As of April 1, 2025, it will no longer be necessary to present a tax payment certificate when undergoing vehicle inspection.

However, if you have just paid or moved to another city or town, the payment history may not be updated in the system and you may not be able to confirm your light vehicle tax payment. In such cases, please note that you may be required to present a paper tax payment certificate, as before.

There are penalties such as late fees and seizure of property.

In addition, if payment of light vehicle tax is delayed, a “late fee” will be charged in addition to the tax amount, regardless of whether the motorcycle has a vehicle inspection or not.

The amount is calculated based on the number of days from the day after the payment deadline to the day the tax is paid.

・If it is within one month: 2.4% per annum will be added.

・If it is more than one month: 8.7% per annum will be added.

*For the period from January 1, 2025 to December 31, 2025

This becomes:

Furthermore, if you fail to pay your taxes, including late fees, you may not be able to sell your vehicle, and in the worst case scenario, your motorcycle and other assets may be seized.

As such, there are various penalties and restrictions for not paying the light vehicle tax, so be careful not to “accidentally forget.”